Introduction

KPIs for a Portfolio Manager: Portfolio managers are responsible for overseeing a collection of projects, programs, and assets within an organization to ensure they collectively align with strategic objectives and deliver maximum value. To effectively manage and assess the performance of these portfolios, portfolio managers rely on Key Performance Indicators (KPIs) and measures. In this blog, we will explore the significance of KPIs for portfolio managers, examine various KPIs and measures they can use, and provide examples to illustrate their importance.

KPIs for Portfolio Manager

The Role of KPIs for a Portfolio Manager

KPIs are quantifiable metrics that help portfolio managers evaluate the performance, health, and strategic alignment of their portfolios. They provide valuable insights into portfolio effectiveness, enabling portfolio managers to make informed decisions, optimize resource allocation, and ensure that the organization’s strategic goals are met. Here are some key reasons why KPIs are essential for portfolio managers:

- Strategic Alignment: KPIs ensure that portfolio components align with an organization’s strategic objectives. This alignment is crucial for achieving the desired business outcomes and competitive advantage.

- Performance Monitoring: KPIs help portfolio managers monitor the performance of projects, programs, and assets within the portfolio, identifying areas that require improvement or attention.

- Resource Optimization: By tracking KPIs, portfolio managers can optimize the allocation of resources, ensuring that they are distributed efficiently across portfolio components to maximize value.

- Risk Management: KPIs provide early warning signs of potential issues or risks within the portfolio, allowing portfolio managers to proactively address them and mitigate their impact.

- Stakeholder Communication: KPIs facilitate clear and transparent communication with stakeholders, helping them understand the progress and impact of the portfolio on the organization’s strategic goals.

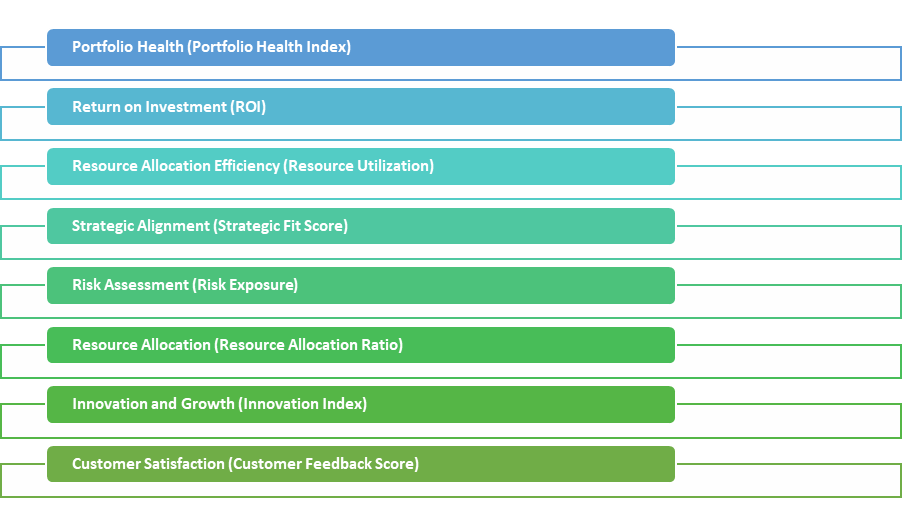

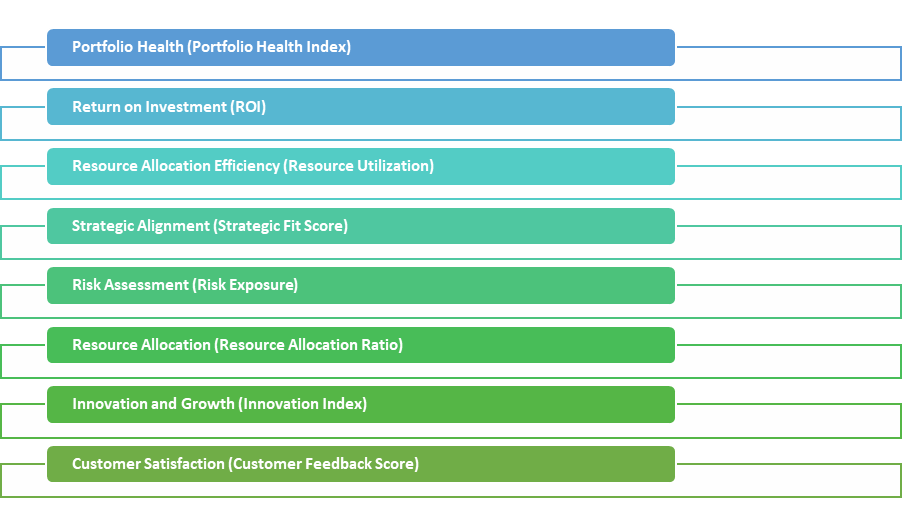

Key KPIs for a Portfolio Manager

KPIs for a Portfolio Manager

- Portfolio Health (Portfolio Health Index)The Portfolio Health Index provides an overall view of the portfolio’s well-being. It includes metrics such as project completion rates, program success rates, and asset utilization rates. A high Portfolio Health Index indicates a healthy portfolio.Example: A portfolio with a Portfolio Health Index of 85% is considered in good health.

- Return on Investment (ROI)ROI measures the return on investment for the portfolio, comparing the total benefits generated by portfolio components to the total costs incurred. A positive ROI indicates that the portfolio is delivering value to the organization.Example: A portfolio with an ROI of 1.2 means that for every $1 invested, the portfolio is generating $1.20 in benefits.

- Resource Allocation Efficiency (Resource Utilization)Resource utilization assesses how efficiently portfolio resources, such as personnel and budget, are utilized across portfolio components. It helps identify resource bottlenecks and underutilization.Example: A portfolio where 90% of available resources are actively contributing to portfolio components demonstrates efficient resource utilization.

- Strategic Alignment (Strategic Fit Score)The Strategic Fit Score measures the alignment of portfolio components with the organization’s strategic objectives. It considers factors such as strategic priorities, market conditions, and competitive positioning.Example: A portfolio with a Strategic Fit Score of 9 out of 10 demonstrates a strong alignment with strategic goals.

- Risk Assessment (Risk Exposure)Risk exposure quantifies the potential impact of identified risks on the portfolio’s success. It considers both the probability of occurrence and the severity of each risk.Example: A portfolio identifies three high-severity risks, each with a 25% probability of occurring, resulting in a total risk exposure of 75%.

- Resource Allocation (Resource Allocation Ratio)The Resource Allocation Ratio measures the allocation of resources among different portfolio components. It helps ensure that resources are distributed in proportion to the strategic importance of each component.Example: A portfolio allocates 60% of its budget and personnel to high-priority projects, 30% to medium-priority projects, and 10% to low-priority projects.

- Innovation and Growth (Innovation Index)The Innovation Index assesses the portfolio’s focus on innovation and growth initiatives. It considers the number of projects or programs aimed at exploring new opportunities and expanding the organization’s market presence.Example: A portfolio with an Innovation Index of 7 out of 10 emphasizes innovation and growth.

- Customer Satisfaction (Customer Feedback Score)Customer feedback score measures the satisfaction of internal or external customers impacted by portfolio components. It is typically collected through surveys or feedback forms.Example: A portfolio with a Customer Feedback Score of 4.5 out of 5 indicates high customer satisfaction.

KPIs for a Portfolio Manager: Conclusion

In conclusion, KPIs and measures are indispensable tools for portfolio managers tasked with overseeing a diverse collection of projects, programs, and assets. They provide a structured framework for evaluating portfolio performance, making data-driven decisions, optimizing resource allocation, and ensuring that the organization’s strategic goals are met.

The selection of KPIs should be tailored to the specific goals and nature of the portfolio. Additionally, KPIs should be regularly reviewed and adjusted as the portfolio evolves to ensure they remain relevant and reflective of portfolio performance. Portfolio managers who effectively leverage KPIs not only measure success but also drive continuous improvement, ultimately delivering value and achieving organizational objectives through their portfolios.